Accounting For Bills of Exchange

Learning Objectives:

- Learn Definition and explanation bills of exchange.

- What are advantages of Bills of Exchange (B/E)?

- What is difference between Bills of Exchange and promissory note?

- How a bill of exchange functions?

- What are the accounting treatments of drawing, accepting, discounting, paying, dishonoring, Retiring a bill.

Now-a-days, business transactions are usually conducted on credit basis. It means that the purchaser of goods pays the price of goods purchased within a specific fixed period of time after the date of the transaction.

On the other hand, the seller/vendor has to wait for his money. In many cases, the vendor cannot afford to do so. He desires payment at the time of selling the goods; but the buyer is not in a position to pay. Then how the matter can be settled so that both the buyer and seller are satisfied? The bill of exchange is one of the means of doing this.

Definition and Explanation of Bill of Exchange

Section 5 of the Negotiable Instruments Act 1981 defines Bill of Exchange as “an unconditional order in writing addressed by one person to another; signed by the person giving it, requiring, the person to whom it is addressed to pay on demand or at a fixed or determinable future time, a certain sum in money to or to the order of a specified person or to bearer.“

The students should keep in mind the following points to understand the definition.

(a) The person who writes out the order to pay is called the drawer.

(b) The person upon whom the bill of exchange is drawn (who is ordered to pay) is called the drawee.

(c) The drawee may ‘accept’ the bill. This is a special use of the word ‘accept’ because it means that he accepts to pay the amount payable expressed in the bill, i.e. If he accepts the obligation to pay he writes ‘accepted’ across the face of the bill and signs it. From that time on he is known as the ‘acceptor‘ of the bill and has absolute liability to honor the bill on the due date.

(d) The amount of money must be mentioned clearly. For example, I cannot make out a bill requiring someone to pay the value of my car or house. That is an uncertain sum. It must say ‘Five thousand rupees or ten thousand rupees.

(e) The time must be fixed or at least be determinable. For example, ‘60 days after date’ is quite easily determinable. If the bill is made out on 1st July, it will be 29th August.

(f) The person who is entitled to receive the money from the acceptor is called the ‘payee’. It is usually the drawer who is supplying goods to the value of the bill, and wants to be paid for them. If the drawer decides, the bill can be made payable to someone else by endorsing it. That is why the definition says, to pay……. to, or to the order of, a specified person.

(g) A bill can be made payable to a bearer, but it is risky, since any finder of the bill or any thief, can claim the money from the acceptor.

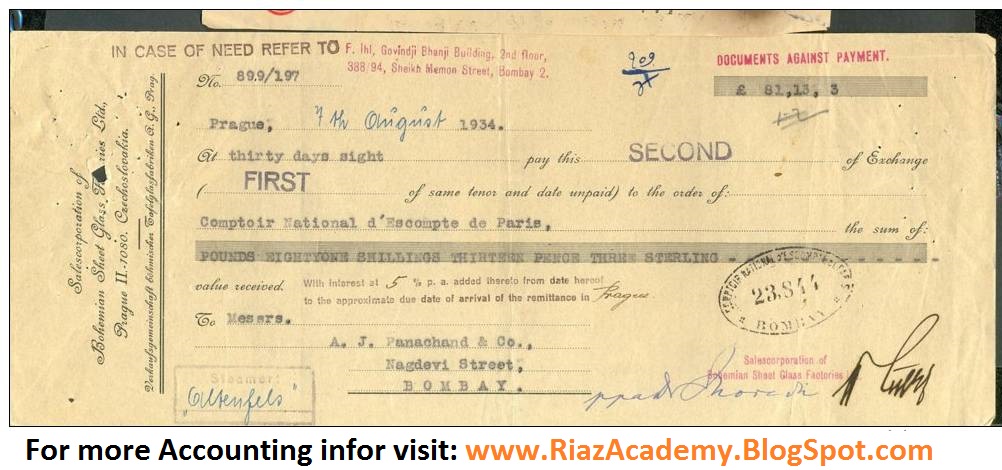

Now read the definition again and see the Sample given below.

Specimen/Sample of a Bill of Exchange:

|

||||||||||||||||||||

Points to be Noted:

a) This bill is drawn by Waseem & Co., so the drawer of the bill is Waseem & Co.

b) The bill is drawn upon Riaz & Co., so they are drawee of the bill. They have not yet accepted the bill, and so are not liable to pay it at maturity.

c) The bill is an unconditional order in writing. It says ‘pay ten thousand rupees to Waseem & Co.’ it does not say ‘provided you are in funds. It just says ‘pay!

d) It is addressed by one person (Waseem & Co.) to another (Riaz & Co.) and is signed by the person giving it (Waseem & Co.).

e) There should be acceptance by Riaz & Co., without acceptance of Drawee there will be no more legal status of bills of exchange.

f) The date is easily determinable, it is 90 days after lst July, which is 29 September, 2016.

g) The sum of money is very certain, ten thousand rupees.

h) The bill is payable to, or to the order of, Waseem & Co.

Parties to a Bill of Exchange:

There are three parties in a bill:

1. Drawer:

2. Drawee:

3. Payee :

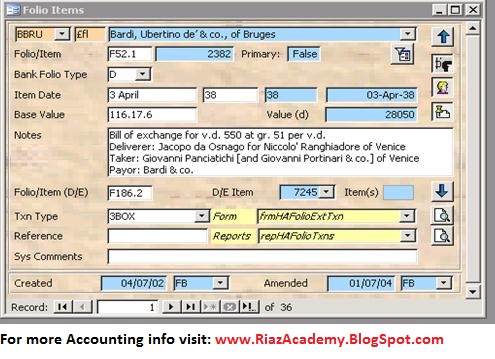

See some other Samples of Bills of Exchange below:

Further Reading:

TYPES OF BILL OF EXCHANGE

CLASSIFICATION OF BILLS OF EXCHANGE

ACCEPTANCE OF A BILL OF EXCHANGE

HOW TRANSACTIONS RELATING TO BILLS OF EXCHANGE ARE RECORDED?

ACCOUNTING TREATMENT FOR BILLS RECEIVABLE AND BILLS PAYABLE

Riaz Academy

Riaz Academy