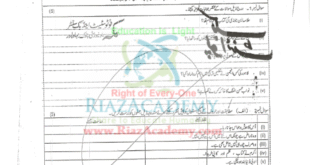

INCOME FROM PROPERTY (SECTION. 15)

From the tax year 2014, Income from property will be taxable under normal tax structure even if the rental income is less than Rs.15000.

1st Calculate Rent Chargeable To Tax (RCT)

|

1. Rental income from property

|

xxxx

|

|

|

2. Income from property

|

xxxx

|

|

|

3. Taxable income from gift property *

|

xxxx

|

|

|

4. For feted amount token money

|

xxxx

|

|

|

5. Rental income from open plot *

|

xxxx

|

|

|

6. Advance tax on property

|

xxxx

|

|

|

7. In case tenant beans the cost of repair 1/4th of

|

xxxx

|

|

|

Actual rent will be included in RCT

|

xxxx

|

|

|

8. 1/10th of Unadjusted advance rent

|

xxxx

|

|

|

9. Property tax paid by tenant

|

xxxx

|

|

|

10. Sighing amount from tenant (nonrefundable)

|

XXX

|

|

|

Total Rent Chargeable To Tax (RCT)

Less:

|

XXX

|

|

|

1. Repair charges (1/5th of RCT)

|

XXXX

|

|

|

2. Leveling and cutting grass

|

XXXX

|

|

|

3. Collection charges (6% of RCT) or actual exp. (Which is less )

|

XXXX

|

|

|

4. Property tax paid

|

XXXX

|

|

|

5. Lawyer fee to defend title

|

XXXX

|

|

|

6. Lawyer fee for drafting master rent

|

XXXX

|

|

|

7. Profit paid on money borrowed for construction

|

XXXX

|

|

|

8. Fire insurance premium

|

XXXX

|

|

|

9. Markup paid on loan acquired

|

XXXX

|

|

|

10. Ground rent

|

XXXX

|

|

|

Total Deductions

|

XXX

|

|

|

Net Amount from Property Chargeable To Tax

|

XXX

|

NOTE: The deduction for repair charges in computing the income from property is not allowed in case of open plot.

DOWNLOAD FROM THE FOLLOWING LINKS

But before Download, Please Like us on Facebook and Share this book on your social media, so that you can be informed about new future Posts.

Note: IF you are unable to find any particular book or novel online, you can simply leave a comment for me asking to upload that particular book or novel. Or you can simply contact me clicking Here